DeFi isn’t just another buzzword. It’s a real, working alternative to the banking system most of us grew up with. While traditional finance runs on centuries-old institutions with brick-and-mortar branches and paper contracts, DeFi runs on code-smart contracts on blockchains-that let anyone with an internet connection borrow, lend, trade, or save money without a bank in the middle. The difference isn’t subtle. It’s a complete rewrite of how money moves.

Who Controls the Money?

In traditional finance, your money is controlled by banks, governments, and regulators. When you deposit $10,000 in a savings account at Bank of America, you’re trusting them to keep it safe, pay you interest, and let you withdraw it when you need to. If they make a bad loan or get hacked, you’re protected by FDIC insurance-up to $250,000 per account. But you’re still relying on them to do the right thing. DeFi flips that. No bank holds your money. Instead, it sits in a smart contract on Ethereum or Solana. These are self-executing programs. If you lend $5,000 in USDC to Aave, the contract automatically pays you interest every second, every minute, every day-no human approval needed. You own your keys. You control your funds. There’s no CEO to call when something goes wrong. If you mess up your wallet seed phrase, the money is gone. Forever.Access: Everyone or Everyone Who Passes Paperwork?

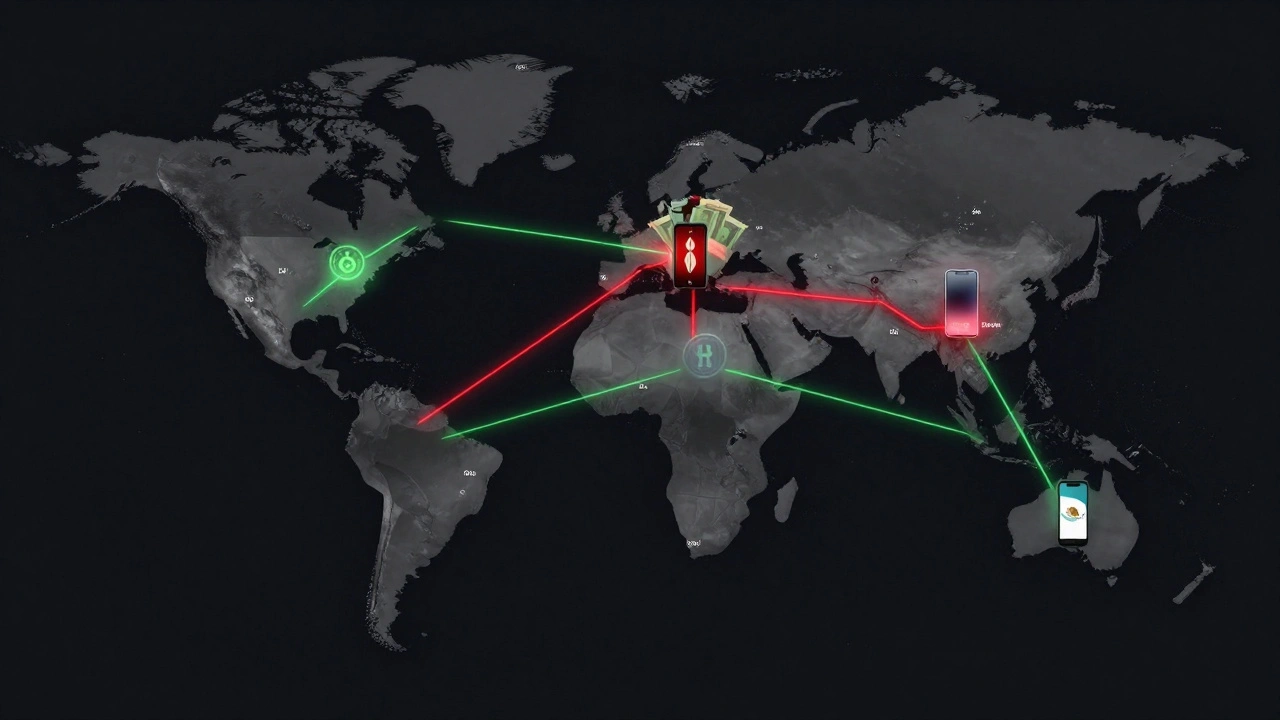

About 1.4 billion adults worldwide don’t have a bank account. They live in places where banks won’t open branches, or they can’t prove their identity to regulators. Traditional finance requires government ID, proof of address, tax numbers, and sometimes even a minimum deposit of $500. In the U.S., opening a checking account takes an average of 2.7 business days and seven documents. DeFi needs none of that. All you need is a smartphone, internet access, and a crypto wallet like MetaMask. No background check. No credit score. No approval process. A farmer in Kenya can send money to her sister in Lagos in under 10 minutes using a Polygon-based DeFi app. No intermediary. No $45 wire fee. No five-day wait. That’s not a feature-it’s a revolution.Speed and Cost: Minutes vs. Days

Sending money internationally through traditional banks? Expect 1 to 5 business days. Fees? Around $45 per transfer, plus hidden currency conversion charges that can add another 2-5% to the cost. Visa and Mastercard charge merchants 1.5-3.5% per transaction. That’s money taken out of small businesses’ pockets every time they get paid. DeFi transactions settle in seconds. On Solana, a payment can be confirmed in 400 milliseconds. On Ethereum, it’s usually under 15 seconds. Fees? Often under $1-even during peak times. In November 2025, the Ethereum Shanghai upgrade slashed gas fees by 42% and boosted transaction speed by 300%. A small business owner in Mexico can now invoice a client in Canada and get paid instantly, with no middlemen taking a cut.

Interest Rates: 0.5% vs. 8%

Your savings account at Chase? Probably paying 0.5% APY. Maybe 0.7% if you’re lucky. The Federal Reserve’s October 2025 data shows the national average for savings accounts is still below 1%. That’s barely keeping up with inflation. On Aave, you can deposit USDC and earn 4.2-8.7% APY. On MakerDAO, lending DAI earns similar returns. These aren’t gimmicks. They’re market-driven rates. Lenders get paid because borrowers need liquidity, and the protocol matches supply and demand automatically. There’s no bank taking 90% of the spread. You’re getting paid directly by the people using your money.Transparency: Hidden Fees vs. Public Code

Traditional finance thrives on opacity. Credit card agreements average 5,700 words-written at a 14th-grade reading level. Hidden fees for late payments, balance transfers, foreign transactions, and even inactivity are buried in tiny print. Morningstar’s 2025 study found that hidden fees eat up 0.5-2% of your asset value every year. DeFi is open by design. Every transaction is on the blockchain. You can look up any smart contract on Etherscan. You can see exactly how much you’re paying in gas fees. You can audit the code. If a protocol charges a 0.3% fee to swap tokens, it’s written into the contract. No surprises. No fine print. You know what you’re signing up for-before you click “Confirm.”Risk: Insurance vs. Self-Custody

Traditional finance has safety nets. FDIC insurance. SIPC protection for brokerage accounts. Regulators who can freeze accounts, reverse fraud, and fine institutions. If your debit card is stolen, you call the bank and get your money back. DeFi has none of that. If you send ETH to the wrong address? Gone. If you approve a malicious smart contract? Gone. If a hacker exploits a bug in a protocol? The $2.8 billion lost in DeFi hacks in 2024 (per Immunefi’s report) isn’t coming back. There’s no customer service line. No insurance fund. You’re responsible for your own security. That’s why 33% of new DeFi users lose money because they mismanage their seed phrases (CertiK, 2025). It’s also why platforms like MetaMask average 3.8/5 stars-people love the freedom but hate the stress. Traditional finance users rate banks lower (2.9/5), but mostly because of slow service and hidden fees-not because they lost everything overnight.

James Winter

December 4, 2025 AT 22:51DeFi? More like De-Fraud. Your ‘revolution’ is just gambling with code no one understands. If you lose your seed phrase, you’re not a victim-you’re dumb. Stop pretending this isn’t a casino.

Aimee Quenneville

December 6, 2025 AT 14:43so… you’re telling me i can lose my life savings… because i typed the wrong letters… and there’s no customer service? 🤔… cool. cool cool cool. my bank charges me $5 for a wire transfer but at least they’ll answer the phone when i cry.

Cynthia Lamont

December 7, 2025 AT 05:34Let’s be real. The ‘8% APY’ is a trap. It’s not ‘market-driven’-it’s a Ponzi payout from desperate borrowers who can’t get loans anywhere else. And that ‘$1 fee’? Try again during a gas spike. You think you’re saving money? You’re just getting fleeced faster. The ‘transparency’ is just a fancy way of saying ‘you’re on your own.’

And don’t get me started on ‘no ID needed.’ That’s not freedom-that’s a money launderer’s dream. Regulators aren’t the enemy. They’re the only thing keeping this from collapsing into a $100 billion dumpster fire.

Yes, banks are slow. Yes, they’re greedy. But they also have lawyers, insurance, and actual consequences. DeFi? One wrong click and your life’s savings vanish into the blockchain ether. No one gets fired. No one goes to jail. Just… poof.

And don’t even mention ‘Kenyan farmers.’ They’re not using DeFi. They’re using M-Pesa. Because it works. And it’s regulated. And someone answers when something breaks.

You think this is innovation? It’s just tech bros pretending they’re Robin Hood while stealing from people who don’t know what a private key is.

The ‘hybrid future’? That’s just banks buying DeFi startups so they can charge you 12% to use your own money. Same game. New name.

Stop romanticizing chaos.

Kirk Doherty

December 7, 2025 AT 21:59DeFi isn’t perfect but it’s moving faster than banks ever will. I don’t need someone in a suit to tell me I can’t send money to my cousin in Nigeria. I just do it.

Dmitriy Fedoseff

December 8, 2025 AT 16:33There’s a deeper truth here. Traditional finance was built on hierarchy-control, exclusion, silence. DeFi is built on access, permissionlessness, and accountability through code. It’s not about replacing banks. It’s about replacing the idea that money should be a privilege.

Yes, you can lose everything. But that’s the price of sovereignty. In the old system, you lose slowly-through fees, inflation, denial of credit, hidden terms. In DeFi, you lose fast. But you own the risk. And that’s the difference between being a customer and being a participant.

People in Kenya aren’t using DeFi because it’s cool. They’re using it because the system refused them. That’s not a bug. That’s the point.

And yes, the code is open. That means anyone can audit it. That means the frauds get found. The bad actors get exposed. That’s not chaos. That’s transparency.

Maybe we don’t need more regulation. Maybe we need more responsibility. The bank didn’t protect you. It just made you dependent. DeFi makes you free. And freedom is messy.

Don’t fear the risk. Fear the system that made you accept it as normal.

Meghan O'Connor

December 9, 2025 AT 09:17‘Slashed gas fees by 42%’? In November 2025? That’s not a fact-it’s fiction. Ethereum didn’t have a Shanghai upgrade in 2025. That was 2023. And USDC isn’t ‘backed by real dollars’-it’s backed by commercial paper and repo agreements. You think that’s safer than a bank? Lol.

And ‘89% have a college degree’? So only the privileged can afford to gamble? That’s not inclusion. That’s elitism with a blockchain.

Morgan ODonnell

December 9, 2025 AT 22:18I get both sides. Banks are slow and expensive. DeFi is fast but scary. Maybe the answer isn’t picking one. Maybe it’s learning to use both. I keep my savings in a bank. But I send crypto to my friends overseas. It’s not perfect. But it works.

Liam Hesmondhalgh

December 11, 2025 AT 12:21Author here. You’re all missing the point. DeFi doesn’t need to be perfect. It just needs to be possible. For the first time ever, someone in a village with no bank can hold their own money. No permission. No paperwork. No gatekeepers. That’s worth the risk.